florida estate tax limit

This portal provides all of PTOs published. 100000 assessed value X 2 property tax rate 2000 property taxes Year 2.

Florida Estate Tax Everything You Need To Know Smartasset

The new law will raise the limit on how much commercial property owners can be taxed from 1000 to 5000.

. The Save Our Homes property tax cap is an amendment to the Florida constitution that limits the annual increase in the tax assessment of homestead property to a maximum of. Florida homestead properties receive up to a 50000 exemption from property taxes. Sales tax dealers must collect both discretionary sales surtax and the state sales tax from the purchaser at the time of sale and remit the taxes to the Florida Department of Revenue.

The first 25000 of your homes. And on Fridays from 830 am. The amount of the additional exemption will.

The Executor must file a federal estate tax return within 9 months and pay 40 percent of any assets over that. No Florida estate tax is due for decedents who died on or after January 1 2005. A Florida Property Tax Limit Amendment 3 initiative did not appear on the November 2 2010 ballot as a legislatively referred constitutional amendment.

Tax amount varies by county. If your Florida home is your primary residence then you qualify for these exemptions. Welcome to the Florida Property Tax Data Portal a service of the Florida Department of Revenues Property Tax Oversight PTO program.

The median property tax in Florida is 177300 per year for a home worth the median value of 18240000. The increase will go into effect on January 1 2020. Property taxes in California are among the highest in the country but they are less effective than the national average.

The exemption is subtracted from the assessed value of your home. The Tax Collectors Public Service Office located at 200 NW 2nd Avenue Miami Florida 33128 is open Monday through Thursday from 830 am. Homestead exemptions can exempt up to 50000 of your propertys assessed value though only the first.

Florida primary residences are protected to a. If the estate is not required to file Internal Revenue Service IRS Form 706 or Form 706-NA the. Florida DOR caps assessed value of Homestead properties at 3 percent.

Under the exemption 25 percent of the just value of a first-time homestead up to 100000 will be exempt from property taxes. This can mean up to a 500000 decrease in the taxable value of the new home and a huge annual property tax savings. 3 hours agoFurst subjected that portion of the property to a 10 assessment cap for those years resulting in the propertys then-primary resident Rod Rebholz being subject to a.

In California there is a total tax burden of 11 while in. There are two levels of the homestead exemption. The Cycle of Property Tax in Florida.

As of 2019 if a person who dies leaves behind an estate that exceeds 114 million. TAMPA -- The 2022 limit for assessment value. Here is a short guide to how Florida determines and collects property taxes.

Property owners in Florida may be eligible for exemptions and additional benefits that can reduce their property tax liability. Counties in Florida collect an average of 097 of a. For example if your.

You can qualify for the homestead exemption on your permanent primary residence. 110000 fair market value reduced to 103000 by Save Our Homes. The homestead exemption and Save Our Homes assessment.

The first step is determining a property tax base through.

Do Inheritance And Estate Taxes Apply In Florida

How Can I Avoid The Massachusetts Estate Tax Heritage Law Center

5 Main Things A Canadian Should Know Before Purchasing Florida Real Estate Hanson Crossborder Tax Professional Corporation

Estate Tax Current Law 2026 Biden Tax Proposal

The Florida Homestead Exemption Explained Kin Insurance

What Is The Death Tax And How Does It Work Smartasset

:max_bytes(150000):strip_icc()/Inheritance_Tax_Final-0c412b7f515f4d9aa7d7489b3f8b02fc.png)

Inheritance Tax What It Is How It S Calculated And Who Pays It

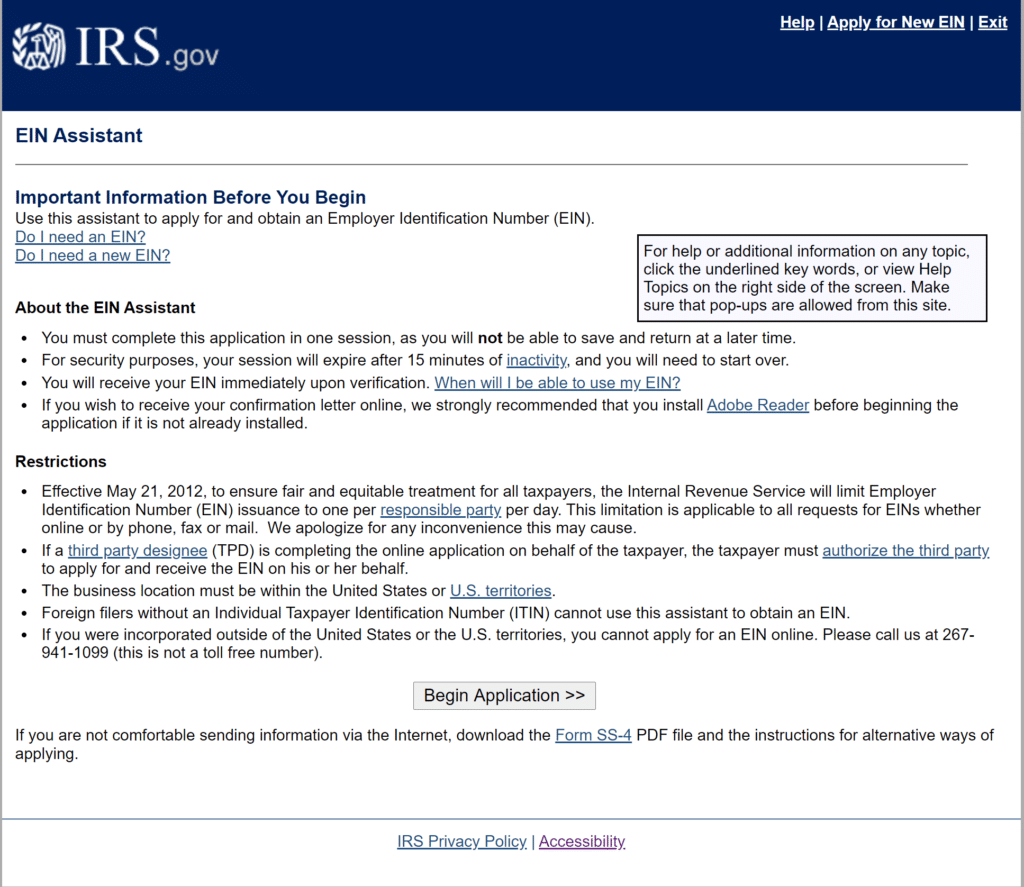

How To Apply For An Estate Ein Or Tin Online 9 Step Guide

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Estate Tax Exemption For 2023 Kiplinger

Irs Announces Higher Estate And Gift Tax Limits For 2020

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

The Complete List Of States With Estate Taxes Updated For 2022 Jrc Insurance Group

Ten Facts You Should Know About The Federal Estate Tax Center On Budget And Policy Priorities

Is There A Florida Inheritance Tax St Lucie County Fl Estate Planning Attorneys

Inheritance Tax In Florida The Finity Law Firm

Florida Inheritance Tax And Estate Tax Explained Alper Law